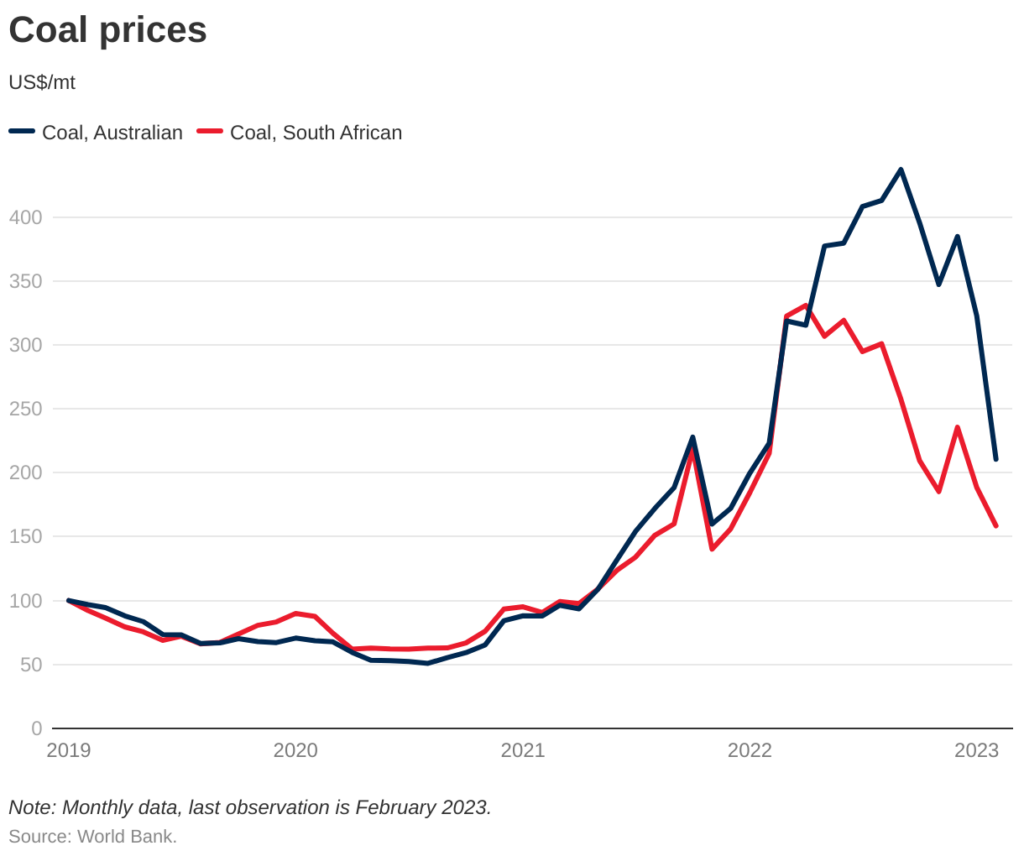

While coal prices are down from their peak in 2022, they’re still significantly higher than the average for the past five years. This is due to booming demand, particularly in China and India. On the supply side, increased exports from South Africa and Colombia have helped fill the gap left by reduced Russian exports to Europe. Although prices are expected to fall further in 2023 compared to 2022, they’ll likely remain elevated. Uncertainties like the war in Ukraine and China’s economic recovery could affect this downward trend.

After reaching record highs, coal prices started dropping in late 2022. This decline is partly due to increased production and milder weather. For instance, benchmark prices in Australia and South Africa have fallen by half since their peaks in September and April, respectively. Previously, a gap existed between these benchmarks because of supply issues in Australia (caused by cyclones) and limited options for Asian buyers to switch from high-quality Australian coal to lower-grade alternatives. However, with increased production and improved weather conditions, this price gap has practically vanished.

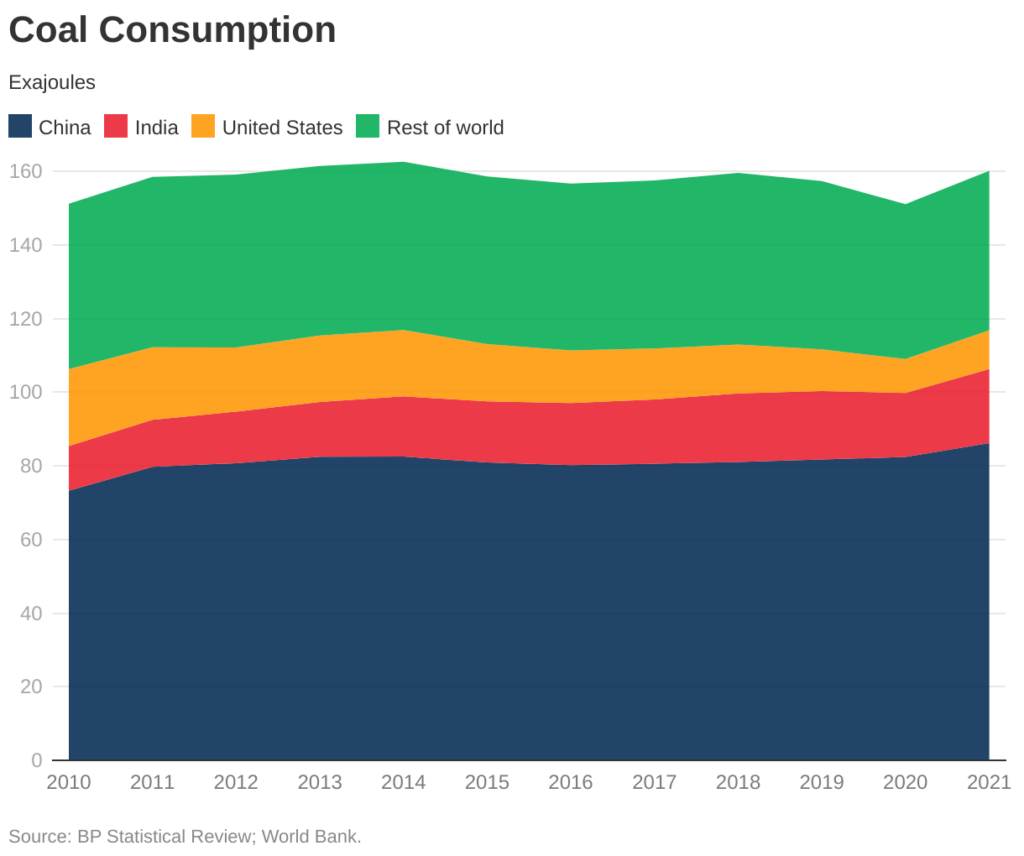

Despite sluggish economic growth in China due to COVID restrictions, global coal use hit a record high in 2022. This surge was driven by a significant increase in consumption from India (10%) and Europe (5%). In Europe, power plants switched from natural gas to coal to compensate for lower production from other sources like nuclear and hydro. The US, however, saw a decrease in coal consumption (8%) during the same period. This is because natural gas prices didn’t rise as dramatically as in Europe, limiting the incentive for power plants to switch fuels.

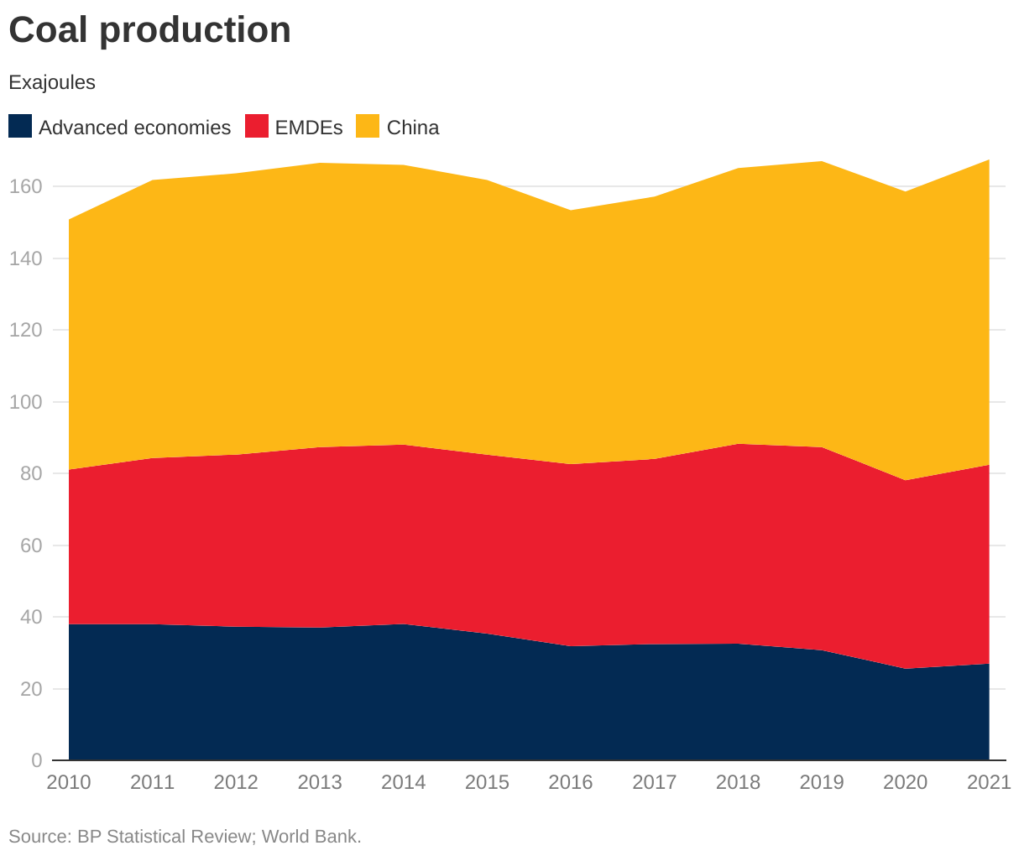

2022 saw record-breaking coal production worldwide. China led the way with an 11% increase compared to the previous year, followed by India with a jump of 16%. The US also saw a 3% rise in production despite a decrease in domestic coal use and logistical challenges. Indonesia exceeded its annual production target by 4%. However, South Africa faced limitations from labor issues and transportation problems, leading to a decline in their output.

While Europe saw a drop in Russian coal imports, increased supplies from Colombia and South Africa filled the gap. South African exports to Europe skyrocketed nearly six times over, while the US maintained similar export levels (though some were diverted to Europe). Following the EU’s ban on Russian coal in late 2022, Russia redirected its exports to China and India, even though their overall exports increased. Indonesia also hit a record high for coal exports in 2022, despite two temporary export bans, with a total increase of 14%.

The outlook for coal suggests both prices and demand will fall in the coming years, although prices will likely stay above their historical average. This is supported by lower coal futures prices compared to 2022. However, some uncertainties could disrupt this decline. Trade disruptions might raise transport costs, and rising gas prices could influence coal prices due to their role as substitutes in power generation. On the demand side, a slower-than-expected economic recovery in China and weaker global growth could dampen projected short-term increases in coal use. In the long term, the war in Ukraine has pushed governments to prioritize a shift away from fossil fuels. As a result, experts predict global coal demand will peak in 2023 and then level off.